In the present fast-evolving commercial environment, the lens of OpEx and CapEx understanding impinges on strategic decision-making ability. Operating Expenses(OpEx) relate to the costs incurred for the daily running of a business; Capital Expenditures(CapEx), however, involve the spending on assets or investments pertinent to a company’s growth. When an organisation appreciates the effects of the two, it will make informed decisions for business success.

Understanding OpEx and CapEx

Operating Expenses include costs incurred during the normal course of business, like rent, utilities, and wages. These are generally considered short-term expenses, and their management should be executed in a way that maximises profitability. On the other hand, CapEx denotes expenditures incurred in acquiring or upgrading physical assets like buildings, technology, or equipment. Usually, it’s a long-term investment for increasing efficiency or facilitating some expansion.

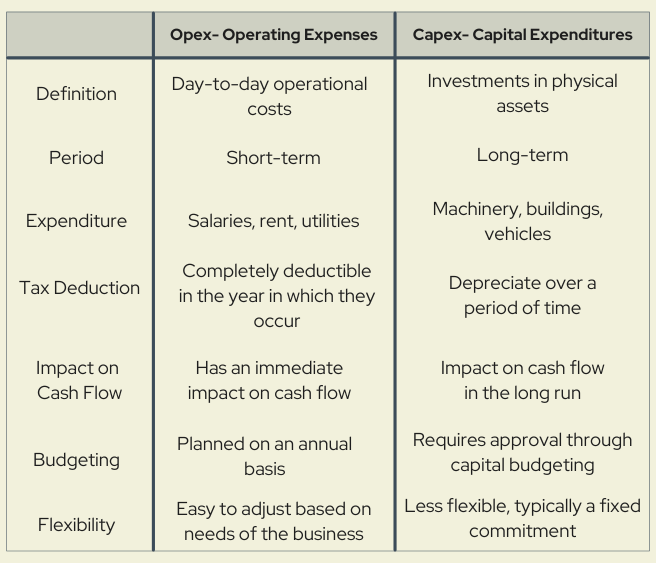

Differences Between OpEx and CapEx

Further clarification on features that help separate OpEx from CapEx is shown in the table below.

Choosing OpEx vs. CapEx

The choice between an OpEx or CapEx consideration has strategic implications with different consequences for business-level costing. Therefore, while making these decisions, the following factors should be considered:

- Business Goals: A clear understanding of overriding business goals will assist in the choice. OpEx may be preferred if immediate project cash flow improvement is required. On the other hand, if the objective is to increase either capacity or efficiency, then CapEx investment may take priority.

- Market Condition: Business operations in a growth phase would find CapEx more reasonable for investments that update all other core areas that are vital for expansion. In contrast, during a recession or market decline, businesses would prefer to limit CapEx and keep OpEx costs in check in order to sustain cash flow.

- Financial Health: In a strong financial position, the company can afford to spend CapEx on growth; however, tighter cash-flowing companies would have to prioritise OpEx, keeping their operations going day by day.

- Operational Efficiency: A deep-dive analysis of existing operations would flag potential areas of OpEx savings by automation or more efficient work practices, thereby freeing resources for strategic CapEx work.

Keeping all these considerations in mind, potential leaders must weigh the pros and cons of both types of expenditures, considering short-term cash flow needs and long-term growth objectives.

Why Financial Courses Are Important:

Given the dynamic nature of global markets, finance courses oriented toward understanding OpEx and CapEx are therefore invaluable. These courses teach professionals how to analyse and manage expenditures so that cohesive and aligned decision-making exists in support of business growth strategies. “The essence of strategy is choosing what not to do,” Michael Porter stated. Therefore, whether to invest in OpEx or CapEx is a strategic decision that will determine the future of a company. Financial courses provide the analytical tools for making such strategic choices; trends in the market, competition, and the technological landscape are just some of the considerations included.

Trends in Financial Management:

Modern-day leaders, more than ever, emphasise data-driven decisions. Financial analytics play one of the most critical roles in the current scenario in studying the impacts of CapEx versus OpEx. With the incorporation of economic tools such as modelling and forecasting, these firms now determine the potential ramifications of their expenditure decisions. Finance courses train students in this area to create alignment of financial strategies with broad business objectives.

Furthermore, the sustainable and responsible approach to financial planning has become the trend. Financing decisions for capital expenditure are increasingly being aligned with sustainability objectives, often seen in the investments made by companies for energy-efficient technologies or eco-friendly infrastructure. Targeted financial education that encompasses such trends ensures that businesses will have a competitive edge in the marketplace.

The Role of Technology and Innovation:

Technology assumes a crucial role in the monitoring and analysis of OpEx and CapEx. Innovations such as artificial intelligence (AI) and machine learning assist companies in the automation of budgeting processes, more accurate forecasting, and identification of cost-saving avenues. These technologies are discussed in financial courses, thus preparing the professionals to utilise them in strategic management. Moreover, digital transformation projects warrant a huge CapEx investment. Hence, it becomes paramount for leaders to capitalise on such projects without undermining operational efficiency.

Conclusion: Strategising for the Future

Therefore, insights from comprehensive finance courses enable a business leader to change OpEx and CapEx management into strategic growth tools. Given the uncertain and competitive business environment, the ability to make informed spending decisions will determine success and even mere survival.

As you ponder your company’s future strategies, consider: Are you effectively leveraging your OpEx and CapEx decisions to drive sustainable growth?

Leave a Reply