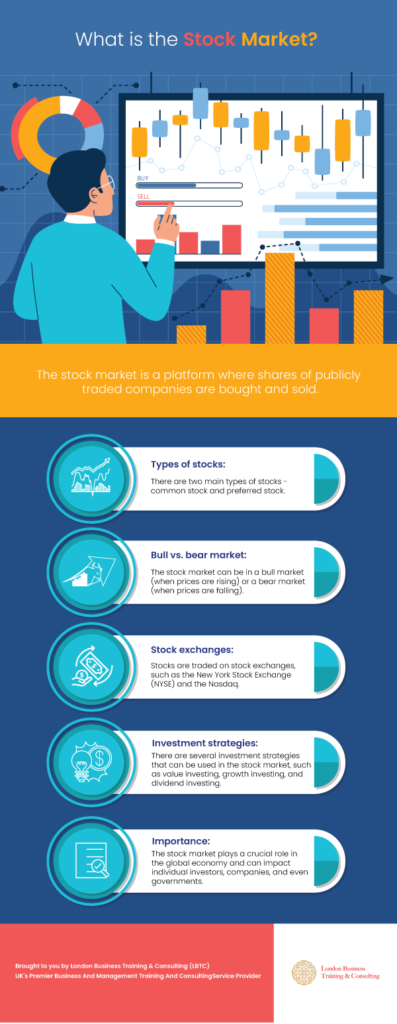

Investors buy and sell shares of companies on the stock market. It is made up of a number of exchanges where corporations issue shares and other assets for trading. Also included are over-the-counter (OTC) markets, which allow investors to transact directly in securities (rather than through an exchange).

The word “stock market” frequently refers to a significant stock market index. They encompass large portions of the stock market. The indexes’ performance accurately reflects the overall market’s performance because it is challenging for keeping track in any organization.

You may come across a news item stating that the stock market has declined or that it closed up or down for the day. The majority of the time, this signifies stock market indexes have changed direction, indicating the value of the index’s constituent stocks has increased or decreased overall. Stock price movement is what drives stock market traders’ desire to make money.

How does the stock market work?

When you purchase stock, you buy a small stake in a publicly traded company.

The New York Stock Exchange and Nasdaq are two of the exchanges that make up the stock market, and you may be familiar with them. An initial public offering, or IPO, is a process by which businesses list shares of their stock on a market. By selling these shares to investors, the company can raise money for business growth. Following that, shareholders can trade these stocks among themselves.

The most fantastic price buyers are willing to pay, known as a “bid,” is typically less than the price sellers “ask” for in return. The term “bid-ask spread” is used to describe this difference. To make a transaction, either the buyer must increase his price or the seller must decrease his.

Even though it may seem complicated, most price computations are typically performed by computer algorithms. You may view the bid, ask, and bid-ask spread on your broker’s website when purchasing stock.

The difference will frequently only amount to a few cents, so inexperienced and long-term investors will be able to handle it.

Why is the stock market even there?

Fractional ownership in a publicly traded corporation may be bought and sold in the stock market, which fulfills this purpose. Hundreds of millions of regular investors receive a portion of the ownership of some of the largest corporations in the world as a result. Also, these investors’ buying and selling choices determine the value of these businesses.

What is volatility in the stock market?

While there are hazards associated with stock market investing, they can be managed minimally with the appropriate investment methods. Day trading, swiftly purchasing and selling stocks in response to price fluctuations, is quite dangerous. On the other hand, making long-term stock market investments has proven to be a great way to accumulate wealth over time.

If you actively buy and sell stocks, you will make a mistake at some point and buy or sell at the wrong time, incurring a loss. The secret to safe investing is to stick with low-cost index funds that monitor the entire market so that your returns resemble the historical average. The financial markets course offered by institutes like LBTC can help you learn the stock market better. Make sure to visit the website to learn more about this course.

Leave a Reply